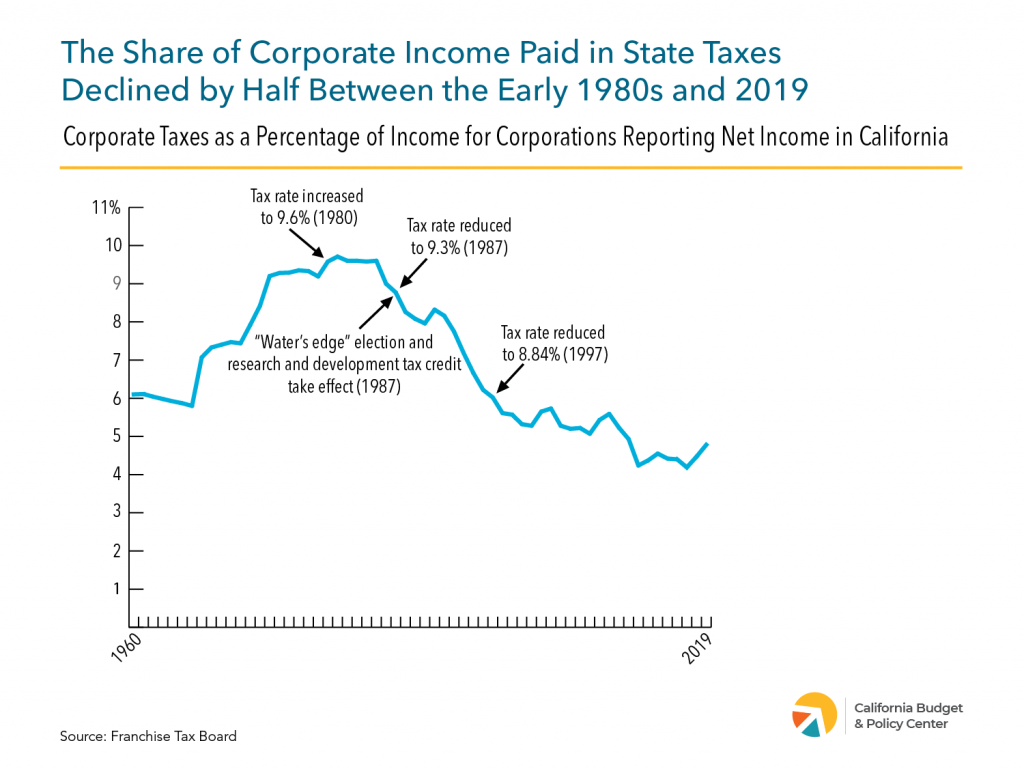

Calling California home means sharing in the responsibility of creating strong communities. Yet, corporations are contributing roughly half as much of their California profits in state taxes than four decades ago. In the early 1980s, corporations that reported profits in California paid more than 9.5% of this income in state corporation taxes. In contrast, corporations paid just 4.8% of their California profits in corporation taxes in 2019, the most recent year data are available. California’s budget would have received $14 billion more revenue in 2019 had corporations paid the same share of their income in taxes that year as they did in 1981 — more than the state spends on the University of California, the California State University, and student aid combined.

Corporations pay less of their income in taxes today than the 1980s in part due to tax rate reductions by state policymakers. The Legislature has cut the corporate tax rate twice: from 9.6% to 9.3% in 1987 and from 9.3% to 8.84%, its current level, in 1997.

In addition to cutting tax rates, state policymakers have enacted several tax breaks that reduce the share of corporate income paid in California corporation taxes. In the 1980s, policymakers established the “water’s edge” election and the research and development (R&D) tax credit — the state’s two largest corporate tax breaks that account for $6.1 billion of the $7.8 billion the state is projected to spend on corporate tax expenditures in 2021-22.

California’s tax break spending for corporations far exceeds tax benefits for Californians with low incomes. In tax year 2020, California spent $1.3 billion on the state’s two largest tax credits targeted to Californians with low incomes — the California Earned Income Tax Credit (CalEITC) and the Young Child Tax Credit (YCTC).1Reflects credits from tax returns processed by the Franchise Tax Board through November 27, 2021. The CalEITC and YCTC benefited 6.6 million Californians in tax year 2020 by boosting the incomes of those with annual earnings of less than $30,000, a large majority of whom are people of color.2The 6.6 million Californians figure reflects the total number of tax filers, spouses, and dependents in 4.2 million “tax units.” Yet, most people get less than $200 from the CalEITC, far too little to help people earning low wages and living in poverty. Policymakers can make tax credits more equitable by providing a larger minimum CalEITC for eligible workers and pay for it by eliminating or reducing tax breaks for corporations that can afford to contribute more to support California communities.