Introduction

The 2017 federal Tax Cuts and Jobs Act (TCJA) included a provision creating a new program designed to encourage private investments in economically distressed communities. The Opportunity Zones program provides federal tax incentives for investments in areas that meet certain criteria and have been designated as Opportunity Zones (OZs). Additionally, Governor Gavin Newsom’s 2019-20 budget proposal would provide state-level tax incentives for investments in OZs. There are 879 designated OZs in California, located in nearly all of the state’s counties. More than 4 million Californians live in these areas and will be potentially impacted by new investments eligible for Opportunity Zones tax incentives. The Opportunity Zones program has the potential to encourage new investments in eligible communities that improve the lives of residents with low incomes. However, the vast majority of the tax benefits will be realized by wealthy investors, and the program may accelerate gentrification in some areas or subsidize investments that offer little or no benefit to community residents.

This Issue Brief, the first in a series of Budget Center publications exploring the Opportunity Zones program, explains the structure of the program, its tax incentives, and how California’s communities may be affected.

The Basics: Opportunity Zones, Qualified Opportunity Funds, and Qualified Opportunity Zone Businesses

The TCJA allowed governors to nominate census tracts for OZ designation following certain federal criteria.[1] To qualify, census tracts must generally be low-income communities, defined as having a poverty rate of at least 20% or a median family income of 80% or less of the metropolitan area or state median family income.[2] States were also permitted to select a limited number of “contiguous tracts” that are not low-income communities but border a qualified low-income community and have a median family income that does not exceed 125% of that of the adjacent qualified low-income tract. Contiguous tracts may not comprise more than 5% of a state’s total selected OZs. Each state was permitted to nominate a total number of OZs not exceeding one-quarter of all eligible low-income tracts. In California, Governor Jerry Brown’s administration nominated 879 census tracts to become OZs, and the US Treasury Department certified all of them. One-tenth of California’s population (10.7%), nearly 4.2 million residents, live in OZ census tracts.[3] These designations will remain in effect for 10 years.

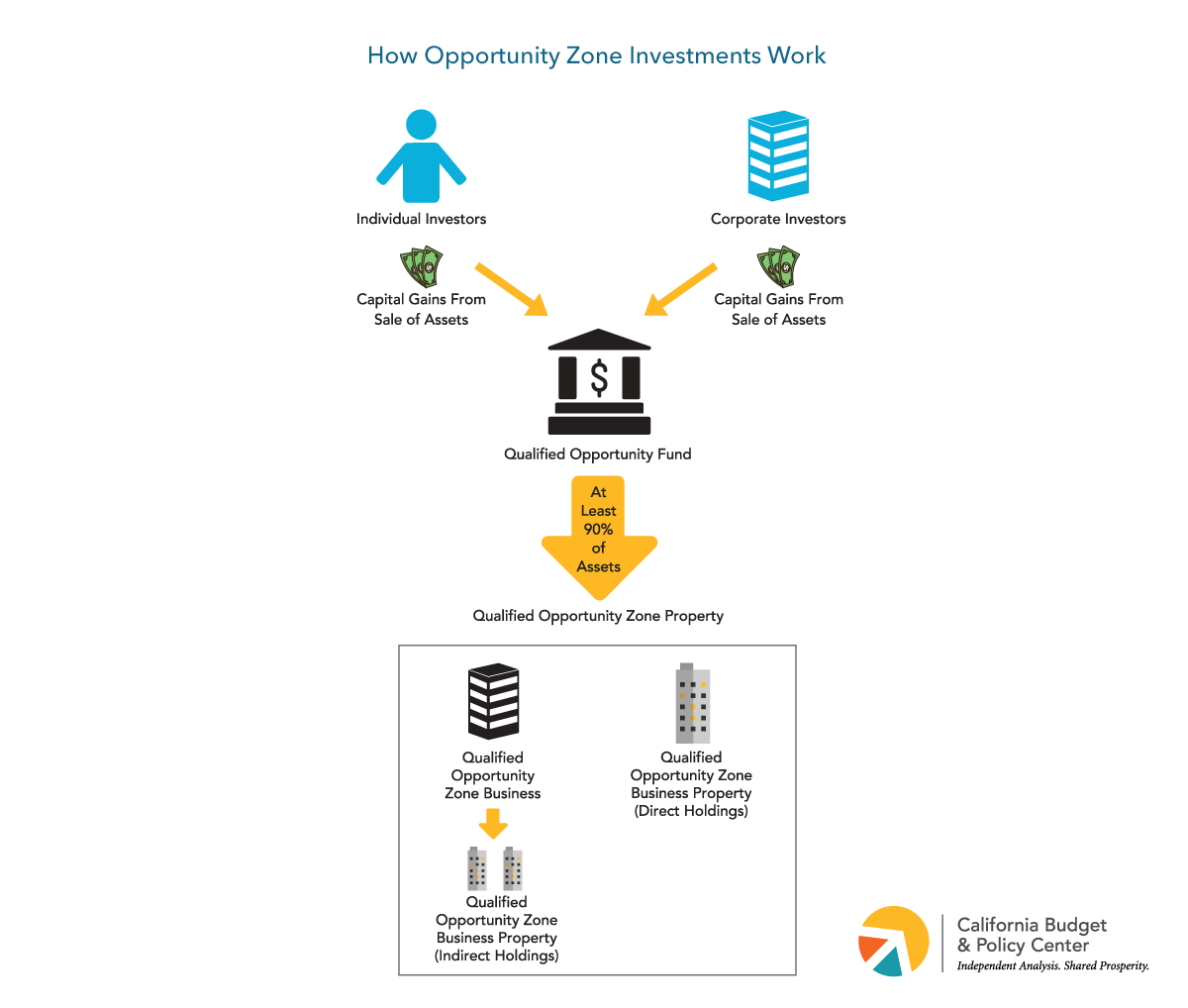

Individuals and corporations that invest in a Qualified Opportunity Fund (QOF) — an entity that in turn makes investments in OZs — are eligible for several tax benefits, discussed below. To be a QOF, at least 90% of the fund’s assets must be invested in “Qualified Opportunity Zone Property,” which may include either a stock or partnership interest in a “Qualified Opportunity Zone Business” that holds tangible property — such as buildings and equipment — in an OZ (known as “Qualified Opportunity Zone Business Property”) or direct holdings of such business property (Figure 1). A QOF, which may be a corporation or partnership, does not need to apply for QOF designation and may self-certify with the Internal Revenue Service (IRS).

Figure 1

The TCJA statute is vague about how much of a QOF’s or Qualified Opportunity Zone Business’ property must be located in an OZ, but the IRS has issued proposed regulations that seek to clarify this issue. If these proposed regulations go into effect, a QOF could have less than half of its assets in use within an OZ and its investors would still be eligible for the full tax benefit.[4]

The law also specifies that, if the original use of the Qualified Opportunity Zone Business Property does not start with the QOF investment, the property must be “substantially improved” — requiring the QOF to spend at least as much to improve the property as it spent to acquire it. Ostensibly, this requirement aims to prevent investors from getting tax benefits by simply buying property in an OZ without adding any value for the community. The IRS’ proposed regulations would make this requirement more flexible, which could increase the likelihood that tax subsidies will go to investments that provide few community benefits.[5]

The broad definitions in the law and the flexibility offered in the proposed regulations mean there will likely be few limitations on the types of investments that will qualify for preferred tax treatment. For example, investments in startup businesses, expansions of existing businesses, construction or substantial rehabilitation of residential or commercial properties, and infrastructure improvements are all likely to qualify. The only businesses explicitly prohibited from receiving Opportunity Zone tax benefits are so-called “sin businesses” including liquor stores, gambling facilities, golf courses, country clubs, tanning facilities, and massage parlors.

The regulations for the Opportunity Zones program have not been finalized at the time of this publication, and the IRS will issue further proposed regulations to clarify other aspects of the law in the coming months. The final regulations will impact the degree to which tax-privileged investments substantively benefit OZ residents and the generosity of the tax benefits for investors.

Tax Incentives for Investors Can Be Lucrative

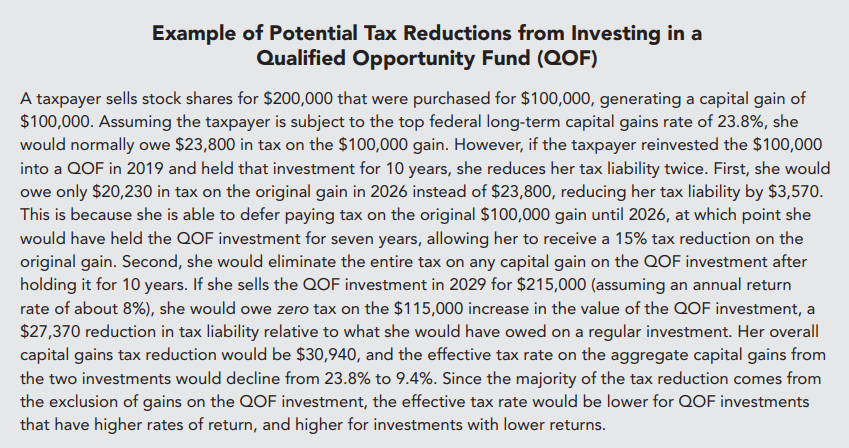

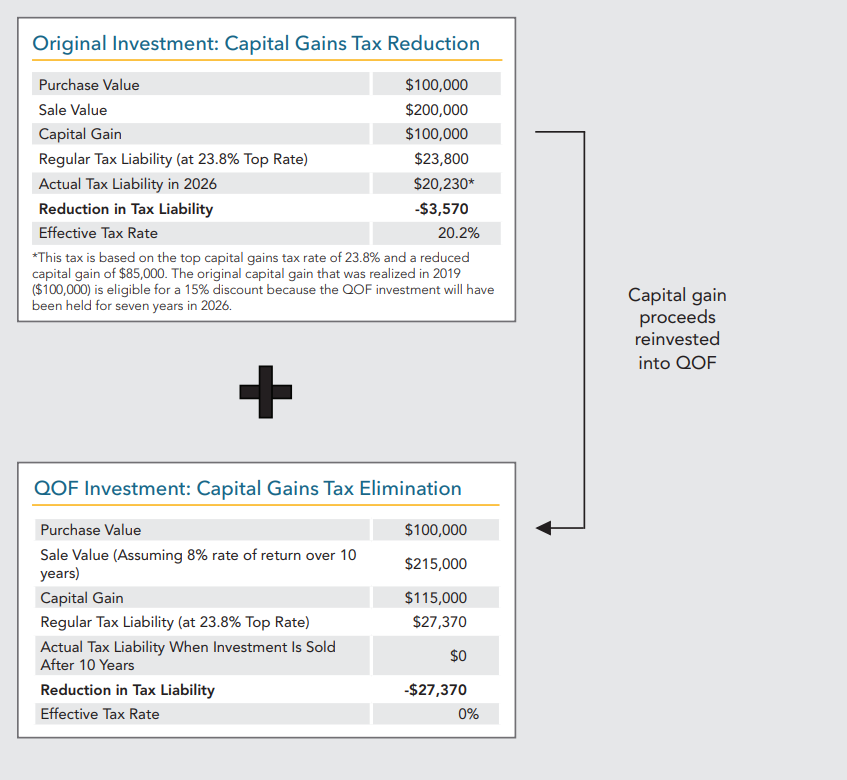

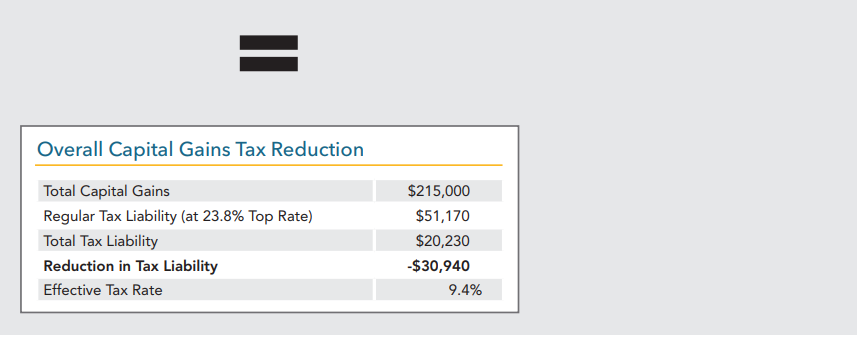

The Opportunity Zones program attempts to promote investments in OZ census tracts by providing several tax breaks on capital gains that are reinvested into a QOF. A capital gain results when a taxpayer sells or exchanges an asset — such as corporate stock shares or real estate — at a price higher than its purchase price.[6] For federal tax purposes, the short-term capital gains tax rate, which applies to gains on assets held for one year or less, is equal to the taxpayer’s ordinary income tax rate, with a maximum rate of 37%. Lower federal rates apply to long-term capital gains on assets held for more than one year. The maximum rate for long-term capital gains is 20% plus a 3.8% surtax related to the Affordable Care Act.[7] Under the Opportunity Zones program, taxpayers reinvesting capital gains into a QOF within 180 days of the sale or exchange of the original investment are eligible for three federal tax benefits:

- Deferral of tax on the capital gain on the original investment until 2026 (or the time the QOF investment is disposed of, if earlier) — allowing the reinvestment of the entire capital gain into a QOF with the potential benefit of a higher return.

- Reduction of tax on the capital gain on the original investment if the QOF investment is held long enough (the taxable value of the capital gain — and thus the tax liability — is reduced by 10% if the QOF investment is held for five years and by 15% if the QOF investment is held for seven years).

- Elimination of tax on the capital gain on the QOF investment if it is held for 10 years.

There is no upper limit on the tax benefits any QOF investor can receive, nor on the overall cost to the federal government in foregone tax revenues. (See text box for an example of the potential tax benefits from investing in a QOF.)

Wealthiest Investors Will Reap Greatest Share of Tax Savings While Community Benefits Are Uncertain

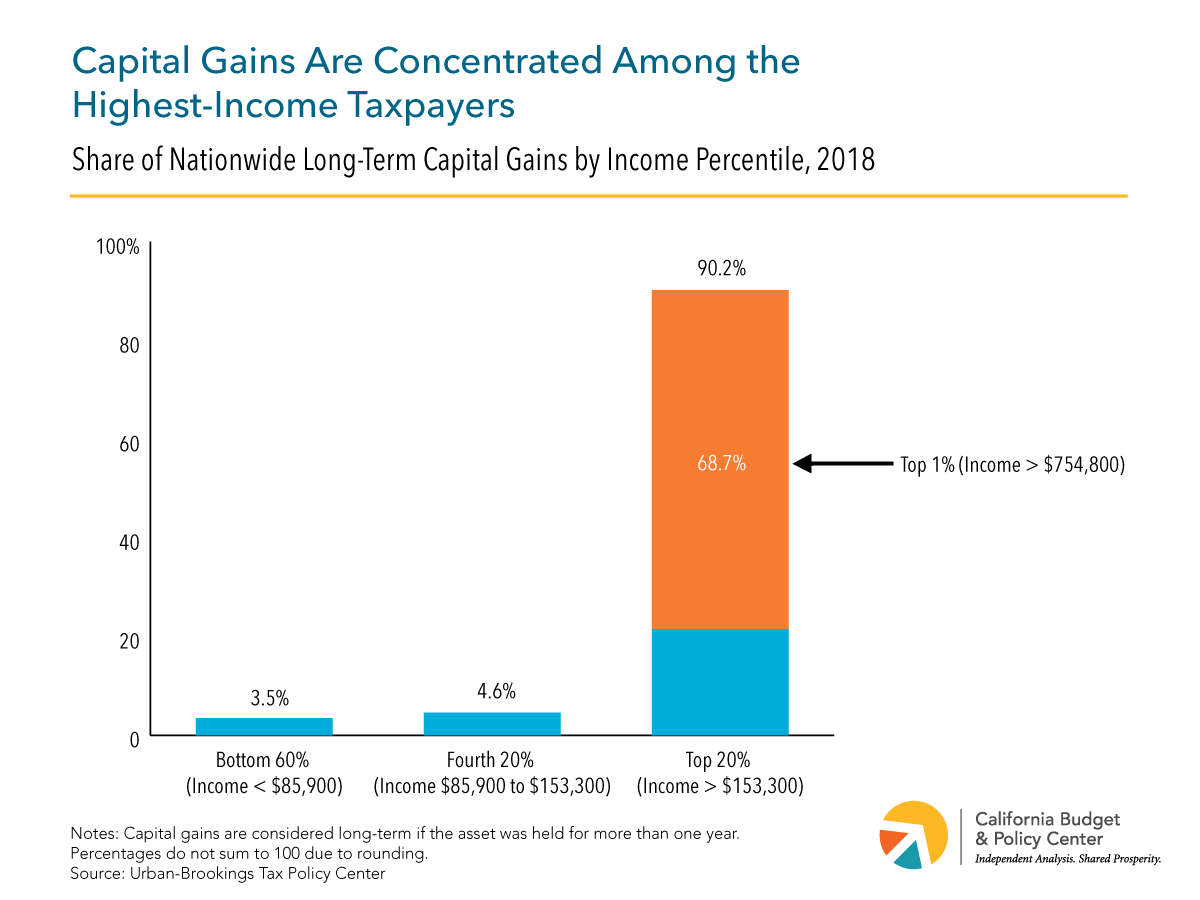

Taxpayers with holdings of appreciated assets will be the direct beneficiaries of Opportunity Zones tax incentives. Most of these benefits will accrue to very well-off investors, who hold a disproportionate share of such assets. Only 9.2% of all taxpayers report realizing any long-term capital gains, according to estimates from the Urban-Brookings Tax Policy Center.[8] In addition, capital gains are highly concentrated at the top of the income distribution. The top 20% receive 90.2% of all reported long-term capital gains, with the top 1% collecting 68.7% of these gains (Figure 2). Thus, very few low- or middle-income families will receive any tax benefits from the Opportunity Zones incentives.

Figure 2

While the benefits to wealthy investors are clear, there is no guarantee that the subsidized investments will positively impact current residents of designated OZs. The Opportunity Zones program is not the first attempt to bring investment and employment into areas that lack financial resources and jobs. A variety of federal and state programs have provided tax incentives and other benefits to attract business and capital investment and to increase employment in such areas, including Empowerment Zones, Enterprise Communities, Renewal Communities, New Market Tax Credits, and state-level enterprise zones. Research on the community impacts of these programs has reached mixed conclusions. Some studies have found increases in employment and wages and reductions in poverty in designated zones relative to similar communities where these incentives were unavailable, while others have found little evidence that the incentives led to statistically significant community improvements.[9] The inconclusiveness of the research exploring the connection between economic development tax incentives and community outcomes suggests that the costs of such incentives may outweigh the benefits.

A primary concern is investors may be drawn to projects or businesses in areas already in the process of gentrification, as these investments will likely yield the highest returns.[10] If investors do prioritize projects in gentrifying areas, a large portion of the tax-preferred investments could flow into communities that have fewer challenges attracting capital, meaning US taxpayers would be unnecessarily subsidizing investments that likely would have occurred without the incentives. The extent to which this occurs will partially depend on which census tracts states designated as OZs. (The next publication in this series will examine California’s selection of OZs, including the share of selected areas showing signs of gentrification.)

Since the professed goal of the Opportunity Zones program is to improve economically distressed communities, and not to give tax breaks to wealthy investors, the primary question should be whether the inflow of funds meaningfully improves the circumstances of residents in those communities. For instance, if the incentive results in more affordable housing or local businesses that create job opportunities for low-income residents, this would be considered a successful outcome — even if wealthy investors become wealthier in the process. However, given the few restrictions placed on the investments that can be made, and the laxness of some of the regulations proposed by the IRS, there is a real possibility that some of these new investments will contribute to the gentrification of communities. For example, QOFs may invest in luxury condominiums or companies that mostly employ high-skilled workers from outside the community. In fact, these types of investments may be more attractive than “social impact” investments due to potentially higher returns. This could put low-income residents at risk of facing increased costs of living or being displaced, harming the very people the incentive is intended to help. And since OZ census tracts have higher concentrations of black and Latinx residents than other communities, this could exacerbate existing racial and ethnic inequities.[11]

Some of the most disadvantaged communities may not see any new investment at all. These communities have a scarcity of assets to attract investors, present higher risks, and offer potentially lower returns. Therefore, investors are more likely to choose projects in areas that are already more advantaged or showing signs of revitalization over neighborhoods that have the greatest need for new resources.

Another consideration is the overall cost of the Opportunity Zones incentives in the form of foregone federal revenues from capital gains taxes. These lost revenues — mostly benefiting high-income investors — could instead help pay for other services that may have a greater impact on vulnerable communities in California and across the nation. The official cost estimate for the tax incentives is small relative to total cost of the TCJA — $1.6 billion over 10 years in a package of nearly $2 trillion in tax cuts.[12] However, the long-run costs could be much greater given that this estimate does not include revenue losses from the complete exclusion of gains on QOF investments held for 10 years, which fall outside the 10-year period for which budget estimates were made.

The high levels of flexibility for investors and uncertainty regarding the potential benefits and harms to OZ residents elevate the need for strong reporting and data collection requirements. The law does not include such requirements, but the US Treasury Department has the discretion to issue them in forthcoming regulations. Thus, until the final regulations are released, it is unknown whether there will be sufficient and transparent information available to determine how the tax incentives are being used and how subsidized investments are affecting the communities in which they are made.

What’s Next for California’s Opportunity Zones?

Now that the selection of OZ census tracts in California has been finalized, state and local leaders are contemplating how to encourage meaningful investments that will improve the lives of people in struggling communities. Policymakers are considering whether to provide state-level tax incentives to make QOF investments even more attractive, how to align existing state and local resources with those investments, and how to ensure transparency and accountability. Given that the federal tax benefits are heavily skewed toward wealthy investors (as would be state-level capital gains tax breaks) and that residents of affected communities may face affordability pressures and displacement risks, any state-level Opportunity Zones incentives should be structured to 1) provide greater opportunities for lower-income community members, 2) safeguard residents against displacement, and 3) avoid providing a windfall for the wealthy at the expense of the state’s finances. Finally, if state and local governments provide additional incentives to encourage investments in OZs, such incentives should be more narrowly targeted to investments likely to benefit current residents, and data collection and evaluation requirements should be established to enable an assessment of whether the incentives are achieving their intended purpose.

[1] The statute governing Opportunity Zones is found in the new Section 1400Z of the US Internal Revenue Code (26 US Code Section 1400Z).

[2] The definition of “low-income community” for the Opportunity Zones program comes from the statute governing the New Markets Tax Credit (26 US Code Section 45D(e)). For a census tract located in a metropolitan area to qualify, it must have a poverty rate of at least 20% or a median family income not exceeding 80% of the greater of the statewide median family income or the metropolitan area median family income. For a census tract not located in a metropolitan area to qualify, it must have a poverty rate of at least 20% or a median family income not exceeding 80% of the statewide median family income.

[3] Rebecca Lester, Cody Evans, and Hanna Tian, “Opportunity Zones: An Analysis of the Policy’s Implications,” State Tax Notes (October 15, 2018), Table 1.

[4] The TCJA requires that “substantially all” of a business’ tangible property be Qualified Opportunity Zone Business Property, “substantially all” of which is in use in an OZ. The law does not define “substantially all,” but the IRS’ proposed regulations would define it as 70% in both cases. This means a business would only need to have 49% of its tangible property in an OZ (70% times 70%). Since the law requires only 90% of a QOF’s assets to be Qualified Opportunity Zone Property, a QOF holding property through an operating business could have as little as 44.1% of its assets being used in an OZ. US Department of the Treasury, Internal Revenue Service, REG-120186-18: Investing in Qualified Opportunity Funds (April 17, 2019), pp. 77-78.

[5] The proposed regulations released in October 2018 specify that only the value of buildings, excluding the value of the underlying land, would be considered in the calculation to determine whether a property has been substantially improved, which would allow more real estate investments to meet this test. Brett Theodos, Steven M. Rosenthal, and Brady Meixell, The IRS Proposes Generous Rules for Opportunity Zone Investors but What Will They Mean for Communities? (Urban-Brookings Tax Policy Center: October 23, 2018). Additionally, proposed regulations released in April 2019 clarify that unimproved land does not need to be substantially improved, but that such land must be used in a trade or business and would not be considered Qualified Opportunity Zone Business Property if it were being held for investment. The IRS is seeking comments on whether additional rules are needed to prevent QOFs from acquiring land in an OZ without adding any value or economic activity. US Department of the Treasury, Internal Revenue Service, REG-120186-18: Investing in Qualified Opportunity Funds (April 17, 2019), pp. 12-14.

[6] Technically, a capital gain is the difference between an asset’s sale price and its “basis,” which equals the asset’s purchase price with some adjustments, such as the cost of commissions for stocks or the cost of improvements minus depreciation for real property.

[7] Thus, the maximum federal tax rate on long-term capital gains is 23.8%. This includes the top long-term capital gains rate of 20%, which for the 2019 tax year applies to taxpayers with incomes above $434,550 ($488,850 for married taxpayers filing jointly). An additional 3.8% surtax on net investment income, including capital gains, helps fund Affordable Care Act benefits. This surtax applies to single taxpayers with incomes over $200,000 ($250,000 for married taxpayers filing jointly). In contrast to federal law, California taxes all capital gains as ordinary income, at a maximum rate of 13.3%.

[8] Urban-Brookings Tax Policy Center, Table T18-0231: Distribution of Long-Term Capital Gains and Qualified Dividends by Expanded Cash Income Percentile, 2018 (November 16, 2018).

[9] See reviews of the literature in Congressional Research Service, Empowerment Zones, Enterprise Communities, and Renewal Communities: Comparative Overview and Analysis (February 14, 2011), pp. 17-18; David Neumark and Helen Simpson, Do Place-Based Policies Matter? (Federal Reserve Bank of San Francisco Economic Letter: March 2, 2015), pp. 2-3; and Rebecca Lester, Cody Evans, and Hanna Tian, “Opportunity Zones: An Analysis of the Policy’s Implications,” State Tax Notes (October 15, 2018), p. 226.

[10] As described by the Urban Displacement Project, gentrification is “a process of neighborhood change that includes economic change in a historically disinvested neighborhood — by means of real estate investment and new higher-income residents moving in — as well as demographic change — not only in terms of income level, but also in terms of changes in the education level or racial make-up of residents.” Gentrification can lead to displacement, meaning long-term community residents are no longer able to live in gentrified communities. See Miriam Zuk and Karen Chapple, “Gentrification Explained” (Urban Displacement Project: 2015).

[11] Brett Theodos, Brady Meixell, and Carl Hedman, Did States Maximize Their Opportunity Zone Selections? Analysis of the Opportunity Zone Designations (Urban Institute: May 2018, revised July 2018), Table 3.

[12] US Joint Committee on Taxation, Estimated Budget Effects of the Conference Agreement for H.R.1, the “Tax Cuts and Jobs Act” (December 18, 2017); Congressional Budget Office, The Budget and Economic Outlook: 2018 to 2028 (April 2018), p. 106.